Welcome to our comprehensive tax extension guide. Whether you’re a seasoned taxpayer or new to navigating the intricacies of the tax system, it’s important to understand what tax extensions are and how they work.

This page is designed to be your one-stop resource for all things related to tax extensions. We’ll cover the benefits of filing a tax extension in more detail, explore how to file one correctly, provide valuable tips to streamline the process and address common misconceptions about tax extensions. Whether you’re seeking clarity on the extension filing process or looking for expert tips, you’ll find everything you need right here.

Let’s dive in so you can make informed decisions about your tax obligations and when a tax extension might be right for you.

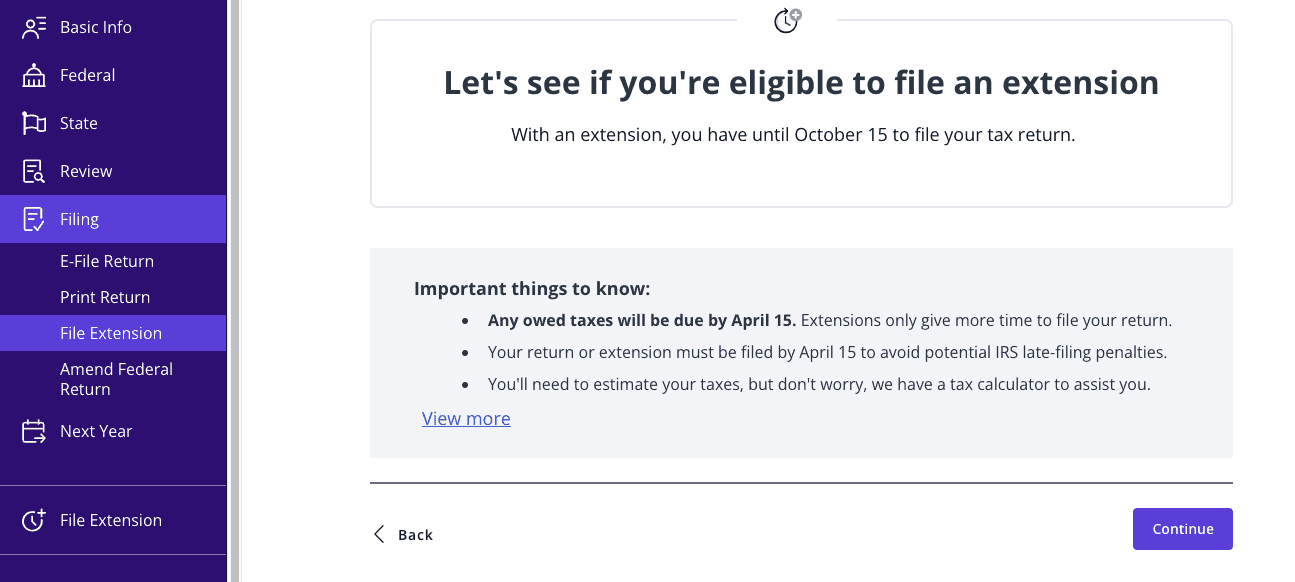

Simply put, a tax extension allows individuals and businesses more time to file their tax returns. By requesting an automatic extension, you can extend the filing deadline (usually April 15) and get six extra months to file, making the new deadline typically Oct. 15.

Having this extra time to file can be extremely helpful if you’re feeling overwhelmed. It allows you more time to gather all the necessary tax documents, review your financial records thoroughly, and ensure that your taxes are filed accurately. Extending the tax deadline can ease the rush and stress of tax season, providing a more thorough and thoughtful approach to tax preparation.

There are several good reasons to file a tax extension. Filing a tax extension with the IRS can be strategic when you need extra time to ensure your tax return is accurate and complete. Here’s a breakdown of why you might consider this option and how to go about it:

Next, we’ll cover some frequently asked questions about tax extensions to ensure you understand who qualifies, if there is a cost to request an extension, and more.

You can always request an extension if you cannot file your tax return by the deadline. The Internal Revenue Service (IRS) doesn’t require you to explain why you need one. Some taxpayers even apply for an extension every year, and that’s OK. It doesn’t matter how much income you have or what your filing status is — everyone can request a tax extension.

No, anyone can file a tax extension for free. However, not paying your taxes on time or failing to request an extension before filing late can result in penalties. We’ll talk more about this in the next section.

The IRS grants those in the armed forces an automatic 180-day extension. If you served in a combat zone or contingency operation, you don’t need to request a tax extension since it’s given to you automatically. Different rules apply depending on whether you live inside or outside the U.S., but IRS Publication 3, Armed Forces Tax Guide, goes over them in detail (see page 29).

Say you are admitted to a hospital for injuries sustained while serving in a combat zone or any other military service. In that case, you must file your tax return 180 days from your release from continuous qualified hospitalization. This 180-day time frame is in addition to the time you already had to file your return when you first entered a combat zone. For instance, if you entered a combat zone on March 1, you would have 46 days left before the April 15 tax filing deadline, plus the additional 180 days. This gives you a total of 226 days to file your tax return.

Yes, you can also get an extension to file your state tax return. When you apply for a federal tax return extension, some states automatically extend your filing deadline, while others require you to file for a state extension separately. It’s best to check with your state to avoid penalties for late filing.

If you don’t have all your tax information and need to file, you might wonder how to calculate how much tax you owe. To do that, you need to complete your return as best you can. Instead of leaving the information out altogether, you can use estimates for any information you don’t have yet. To do this, use your last pay stub for the tax year to help estimate the taxes you may owe.

In this instance, it’s better to overpay than underpay. If you overpay, the IRS will give you the excess back as a tax refund when you eventually file. But if you underpay, you will probably owe penalties.

You can file for an extension if you know you’re getting a tax refund, but you should always try to file your tax return as soon as possible. Remember that you have a limited time to file your return and receive your tax refund. Typically, you have three years from the due date of the return to file and still receive a tax refund check from the IRS.

Tax extensions offer numerous advantages for filers, but they aren’t always the best option. Let’s explore some of the benefits of filing a tax extension and when NOT to file an extension.

Many people ask whether tax extensions give you more time to pay your tax bill. While tax extensions give you more time to file, you still need to pay any tax due by the April due date. An extension does not give you more time to pay your tax bill.

You can request an IRS payment plan if you need more time to pay your tax bill. The IRS offers short-term payment plans and long-term installment agreements — you can even set these up through TaxAct® when you e-file with us. Keep in mind that even with a payment plan, you will still owe applicable interest and penalties until your tax bill is paid.

While tax extensions can be beneficial, they aren’t the best option for everyone. Here are three reasons why an extension may not be the best choice for you:

Wondering how to request an extension? This section provides a guide to filing a tax extension for individuals, plus answers to common questions.

You must request a tax extension by Tax Day (April 15, 2024). Note that this does not affect the date tax payments are due; it is just the filing deadline. Once granted an extension, you’ll have until Oct. 15, 2024, to file your tax return.

The easiest and most convenient way to request an extension is by using IRS Form 4868. You can easily do this through TaxAct when you file with us. Our tax preparation software can also help estimate your tax liability and allow you to file any necessary state extensions. There is an option to print out Form 4868 and mail it as well.

To complete your extension request, you’ll need basic information such as your name, Social Security number, and address. If this information has changed since your last tax filing, ensure you update the relevant organizations beforehand.

By using TaxAct to file your tax extension electronically, you can streamline the process, reduce stress, and gain the extra time needed to prepare and file your federal income tax return accurately.

The IRS offers tax extensions for businesses as well. Here is our guide to filing a business tax extension.

Yes. Sole proprietorships, partnerships, corporations, and limited liability companies can all file a six-month business tax extension request to get extra time to file without penalty. Different business types use different extension request forms (more on that below).

The deadline to request a business tax extension depends on your business type:

Note that if any of the above dates fall on a weekend or holiday, the deadline is pushed to the next business day. For example, in 2024, the extended deadline for partnerships and S corps is Sept. 16, as the 15th falls on a weekend.

To request an extension for your business, you’ll need a different form depending on your business type:

TaxAct makes it simple to file Form 4868 or Form 7004.

For Form 4868:

If you need help filing Form 4868 with TaxAct, please read our Form 4868 help topic for answers to your questions and further details.

For Form 7004:

For more detailed information about filing Form 7004, reference the IRS instructions for Form 7004.

Form 4868 will ask you to provide your name, Social Security number, and address. You’ll also need to estimate any tax liability for the current tax year.

Form 7004 will ask you to indicate which type of return you are requesting the extension for. You’ll also need to provide basic information about your business, such as your business structure, business address, and applicable EINs. Lastly, you’ll need to estimate your tentative total tax and include any payments and credits to determine how much tax you owe.

If you’ve already filed for a tax extension this year, great job! Don’t get too comfy, though. You have six extra months to file, but what should you do after filing a tax extension? Follow our top tips to help you navigate the extension tax filing process smoothly and effectively.

First, try to use the additional time to finish as much of your tax return as early as possible before the new deadline. Even if some information is still missing, like data from third-party sources or documentation on specific deductions, making estimations and indicating these placeholders in your return can simplify the final filing process. This proactive approach reduces the chance of last-minute rushes and potential mistakes.

Keeping comprehensive tax notes can prove invaluable during the tax preparation phase. Maintaining a detailed list of required documents, unanswered questions, and calculations can serve as a reference guide when you’re finally ready to file. These notes not only help in gathering the necessary information but also provide a clear explanation of figures and decisions made on the tax return if any clarifications are needed later.

Another key aspect of staying on track is organizing tax documents effectively. A tax return checklist can be helpful in this stage. Arranging paperwork, receipts, statements, and other relevant documents in a structured format ensures easy access and efficient retrieval when filing your tax return. Additionally, annotating documents with relevant information and checkmarks to indicate items already included in the return can further streamline the process.

As the October deadline approaches, prioritizing completing your tax return becomes critical. Avoiding unnecessary delays or procrastination can alleviate stress and potential issues down the line. While it may be tempting to hold off in hopes of uncovering additional tax deductions, it’s essential to strike a balance and file your return as soon as you can. Remember, the longer you wait, the more challenging it will be to recall relevant financial transactions and deductions.

It’s important to factor in any payments made during the initial extension filing on April 15. Accurately incorporating these payments into your tax return is necessary to ensure that all financial aspects are accounted for and compliant with IRS regulations.

We know that a tax extension gives you an additional six months to complete your tax return, shifting the deadline to Oct. 15, 2024. While it may be tempting to relax and postpone tax-related tasks, it’s essential to stay focused and consider a few key points before putting taxes aside. Here are three things to consider after filing for a tax extension.

As the tax extension filing deadline approaches, it’s natural to feel a sense of urgency to complete your tax return. However, rushing through the process can lead to errors or oversights that may result in paying more taxes than necessary or receiving inquiries from the IRS regarding mistakes. Before finalizing your tax return, it’s crucial to take a step back and ensure everything is accurate and complete. Here are our tips for beating the tax extension deadline.

Putting off doing your taxes until the last minute can cause stress and may lead to fines. It’s best to get your taxes done early, keep things in order, and track your spending closely. After asking for more time to file, finish your taxes quickly to prevent problems and make the most of tax breaks.

To streamline the filing process and alleviate future stress, consider starting your tax return with TaxAct now. Our tax software saves your progress as you file for a smoother filing experience as the deadline approaches, allowing you to file with confidence and accuracy.

File your taxes online with confidence.